Simple Ira Limits 2025. You can contribute up to $16,000 (or. Here are projections for the 2025 irmaa brackets and surcharge amounts:

The 2025 simple ira contribution limit for employees is $16,000. Simple ira contribution limits for 2025.

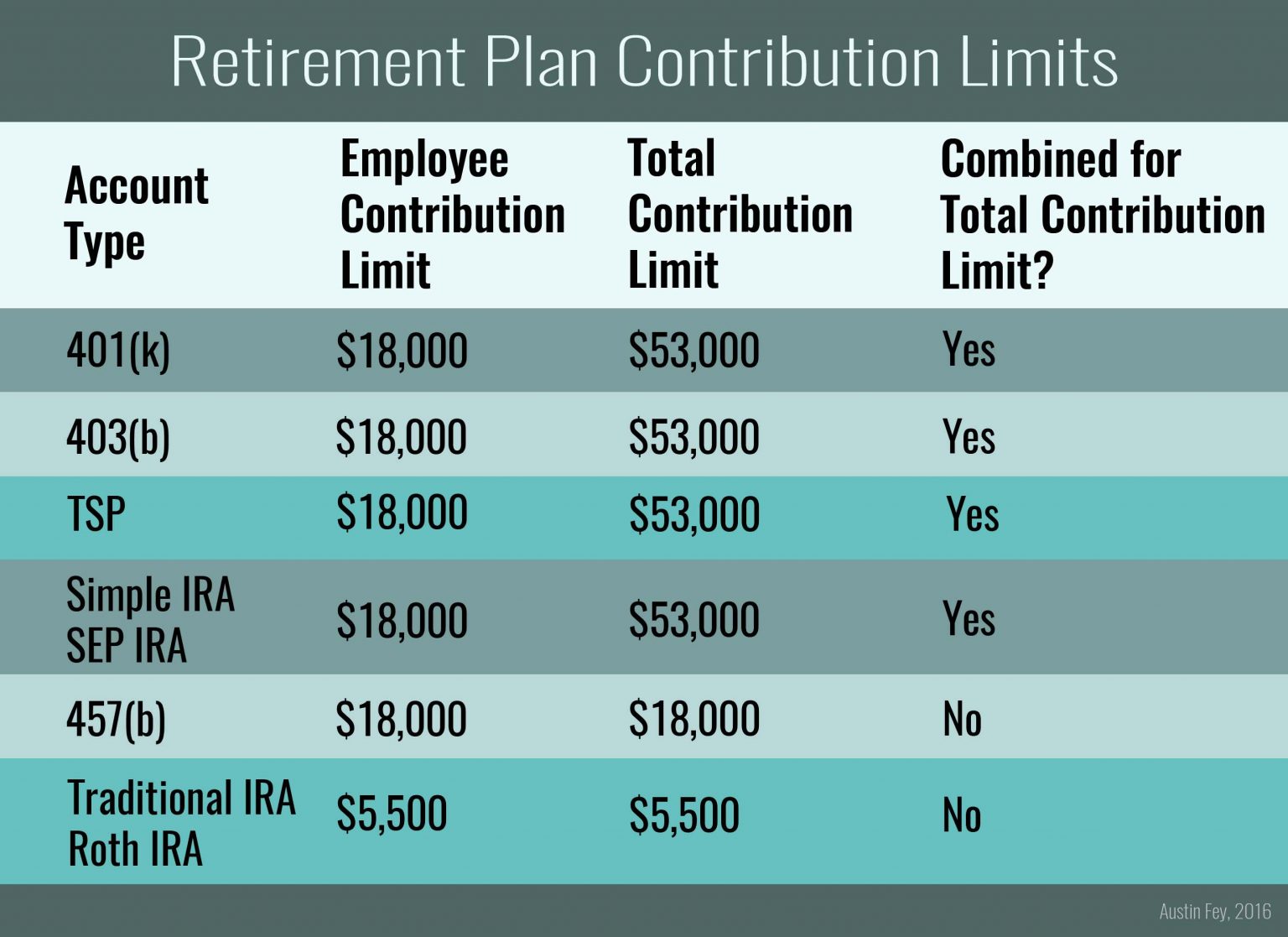

SIMPLE IRA Rules, Providers, Contribution Deadlines & Limits Small, The 2025 simple ira contribution limit for employees is $16,000. To qualify for a simple ira, an employee must have earned at least $5,000 in pay during the past two calendar years and expect to earn at least that amount in the current year.

simple ira contribution limits 2025 Choosing Your Gold IRA, Simple ira contribution limits for 2025. Here are projections for the 2025 irmaa brackets and surcharge amounts:

IRA Contribution Limits 2025 Finance Strategists, To qualify for a simple ira, an employee must have earned at least $5,000 in pay during the past two calendar years and expect to earn at least that amount in the current year. That's up from the 2025 limit of $15,500.

Roth Ira Contribution Limits Calendar Year Denys Felisha, For a simple ira max contribution in 2025, an employee under age 50 can contribute up to $16,000. The simple ira contribution limit for 2025 is $15,500.

Contribution Limits 2025 Ira Kaye Savina, Like other retirement plans, there are also simple ira contribution limits. The maximum simple ira employee contribution limit is $16,000 in 2025 (an increase from $15,500 in 2025).

SIMPLE IRA Contribution Limits for 2025, Defined contribution retirement plans will be able to add. Those numbers increase to $16,000 and $19,500 in 2025.

Choosing The Best Small Business Retirement Plan For Your Business, The maximum simple ira employee contribution limit is $16,000 in 2025 (an increase from $15,500 in 2025). Like other retirement plans, there are also simple ira contribution limits.

Simple Irs Contribution Limits 2025 Dore Nancey, The maximum simple ira employee contribution limit is $16,000 in 2025 (an increase from $15,500 in 2025). A simple ira can accept roth contributions (effective january 1, 2025).

Tax Limits for SIMPLE IRAs, To qualify for a simple ira, an employee must have earned at least $5,000 in pay during the past two calendar years and expect to earn at least that amount in the current year. Defined contribution participants between the ages of 60 and 63 will be able to sock away up to $10,000 ($5,000 for simple plans) in annual.

SIMPLE IRA Contribution Limits 2025 & How to Maximize Them, For 2025, you can contribute up to $7,000 to a roth ira if you're under 50. That's up from the 2025 limit of $15,500.

The simple ira contribution limit increased by $500 for 2025, and workers at small businesses can contribute up to $16,000 or $19,500 if 50 or over.